german tax calculator married

With this tax rate however only the income without parental allowance is taxed so that the tax amounts to 5044 Euro. Individual assessment Einzelveranlagung with a basic tax rate 26a EStG Joint assessment Zusammenveranlagung with income splitting 26b EStG Divorced and widowed persons are assessed individually.

Income Tax In Germany For Expat Employees Expatica

Here are the most important features of Ehegattensplitting joint tax assessment.

. Income up to 9984 euros in 2022 is tax-free Grundfreibetrag. One earns 59 and the other 41 or it is 5050. I did it last year and it was really easy.

Gross Net Calculator 2022 of the German Wage Tax System. The average monthly net salary in Germany is around 2 400 EUR with a minimum income of 1 100 EUR per month. These figures place Germany on the 12th place in the list of European countries by average wage.

Married couple with two dependent children under age 18 years. I can only recommend it. Your feedback is very important to us to build the best tax solution.

Employees pay a salary tax every month. Whether its a diesel petrol or electric car motorcycle truck or camper. For married or registered couples where both partners earn roughly the same money ie.

This report is called Anlage EÜR in German. This program is a German Wage Tax Calculator for singles as well as married couples for the years 2010 until 2022. Charitable donations to German charities are deductible up to 20 of gross income.

Marriage has significant financial implications for the individuals involved including its impact on taxation. Salary tax is an estimation of your income tax. Married couples have the following options.

Motor vehicle tax calculator. The so-called rich tax Reichensteuer of 45. Resulting in the same monhtly tax payments as under tax class I.

There are two exceptions that allow them to still benefit from income splitting. The chart below will automatically visualise your estimated net and gross income. First add your freelancer income and business expenses to the calculator.

Under joint tax filing in Germany the income of the spousescivil partners is determined separately but then added together and submitted to the tax office as a joint income tax return. I could complete my tax return myself with it. You are living in Berlin the capital of Germany.

In return the income tax would amount to 6198 Euro which corresponds to a tax rate of 194 percent. This will generate your estimated amount for your Profit and Loss statement. The calculator covers the new tax rates 2021 German Income Tax Calculator This program is a German Income Tax Calculator for singles as well as married couples for the years 1999 until 2019.

This calculator is useful if you want to find a job in Germany and estimate your cost of living but its not perfect. Calculate here quickly easily and for free how much net remains of your gross salary. Limits of the tax calculator.

I can just say tops. In 2022 the first 9984 or 19968 for married couples submitting a combined tax return earned is tax-free. German Freelance Tax Calculator.

With our calculator for motor vehicle taxes you know before buying how tax is due for your new vehicle. Rental income from German sources of one spouse totals a loss of EUR 5000. Any amount over that is subject to income tax.

Salary tax is an approximation. This is a sample tax calculation for the year 2021. 2022 2021 and earlier.

Without a progression reservation the tax for an income of 26000 Euro would be only 4333 Euro. Church tax of EUR 1205 wage church tax. But for parents with a total income above 69027.

2021 every single-parent or married couple receives having a child under 25 - still in professional training living in GermanyEU and which is normally more favourable then the lump sum 8388. This Wage Tax Calculator is best suited if you receive a salary only as an employee on a German payroll. For both instances I will assume a monthly gross salary of 3500 Euros in the accounting year 2022 the tax class 3.

Start tax class calculator for married couples. Financial Facts About Germany. Online Calculators for German Taxes.

Then add your private expenses to calculate your taxable income. For married or registered couples where the partner earns less than 40 of the family income. An employee with an yearly income of 9744 wont have to pay income tax for married employees the limitation will be 19488.

German Wage Tax Calculator. If you only have income as self employed from a trade or from a rental property you will. Income more than 58597 euros gets taxed with the highest income tax rate of 42.

The calculator will produce a full income tax calculation simply by. It is a progressive tax ranging from 14 to 42. I II III IV V VI.

Married couples and civil partnerships can receive back-dated refunds on tax. About the income tax tarif 32a. Enter your gross income for the chosen period monthly or yearly Monthly Yearly.

Germany is not considered expensive compared to other European countries the prices of food and housing. Calculator Germany is not considered expensive compared to other European countries the prices of food and housing being only slightly higher than the EU. Donations of EUR 250.

The calculator below can help estimate the financial impact of filing a joint tax return as a married couple as opposed to filing separately as singles based on 2022 federal income tax brackets and data specific to the United States. Married couple with two dependent children under age 18 years. The German Annual Income Tax Calculator for the 2022 tax year is designed to provide you with a salary payroll and wage illustration with calculations to show how much income tax you will pay in 202223 and your net pay the amount of money you take home after deductions.

Both are considered as one tax-paying unit and receive a joint tax assessment. For this example I assume that you also have to pay church tax have no children and you have health pension and unemployment insurance. Have been doing my income tax return via Wundertax for two years and its very well written and easy to use.

To calculate the German income tax you owe on your wages. This program is a German Income Tax Calculator for singles as well as married couples for the years 1999 until 2022. Its missing many important tax deductions.

German Wage Tax Calculator Expat Tax

Best Sales Tax Calculator For Us States And Other Countries Geekflare

Calculate Your Taxes In Germany Immigrant Spirit

Income Tax Einkommenssteuer Ww Kn Steuerberater Fur Den Mittelstand Ww Kn

German Payroll Example For 95000 95k Income Ta

Best Sales Tax Calculator For Us States And Other Countries Geekflare

German Income Tax Calculator Expat Tax

What Are Marriage Penalties And Bonuses Tax Policy Center

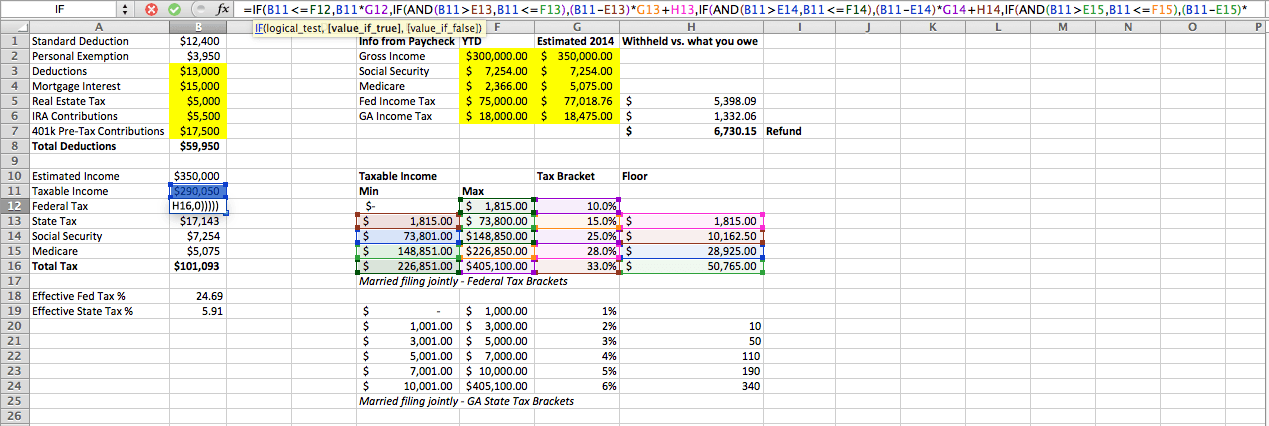

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

4 000 A Month After Tax Ca July 2022 Incomeaftertax Com

Excel Formula Income Tax Bracket Calculation Exceljet

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download